Bank of England base rate

The current base rate is 225. Bank of England increases interest rates to 30-year high of 3 - Bad news for the pound The Bank of England has confirmed yet another interest rate rate rise to three percent.

Bank Of England Weighs Biggest Interest Rate Rise In 33 Years

Despite the Bank of England increasing the base rate of interest by 075 percentage points - the biggest hike since 1989 - lenders may now cut the cost of mortgages for some.

. It sees the Banks base interest rate rise from. Continue reading to find out more about how this could affect you. 47 rows The base rate is the Bank of Englands official borrowing rate.

The Bank of England base rate is currently. The base rate was previously reduced to 01. The base rate has changed to 225 Theres no need to call us well write to you if there are any changes to your payments as a result of the base rate increase on 22nd.

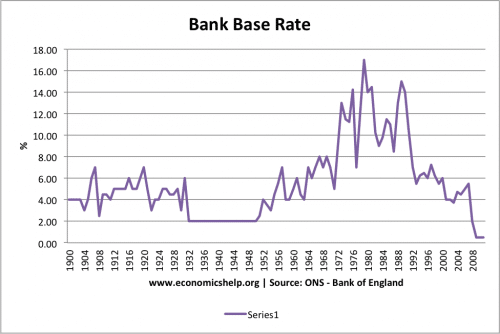

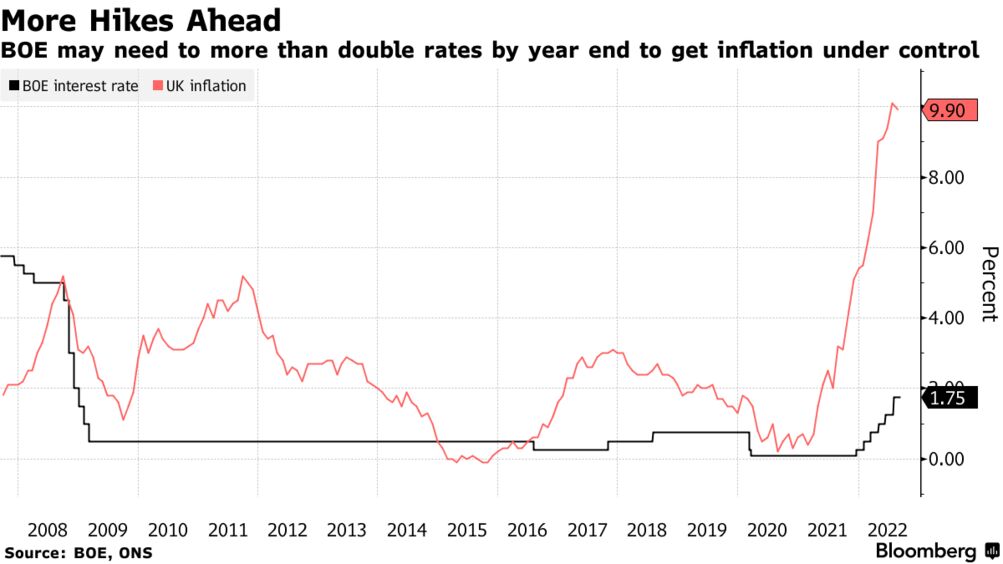

The base rate is expected to finish the year above 3 and could peak at close to 41 in June 2023 based on interest-rate derivatives linked to the meeting dates of Threadneedle. The Bank of England base rate is currently at a high of 3. Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability.

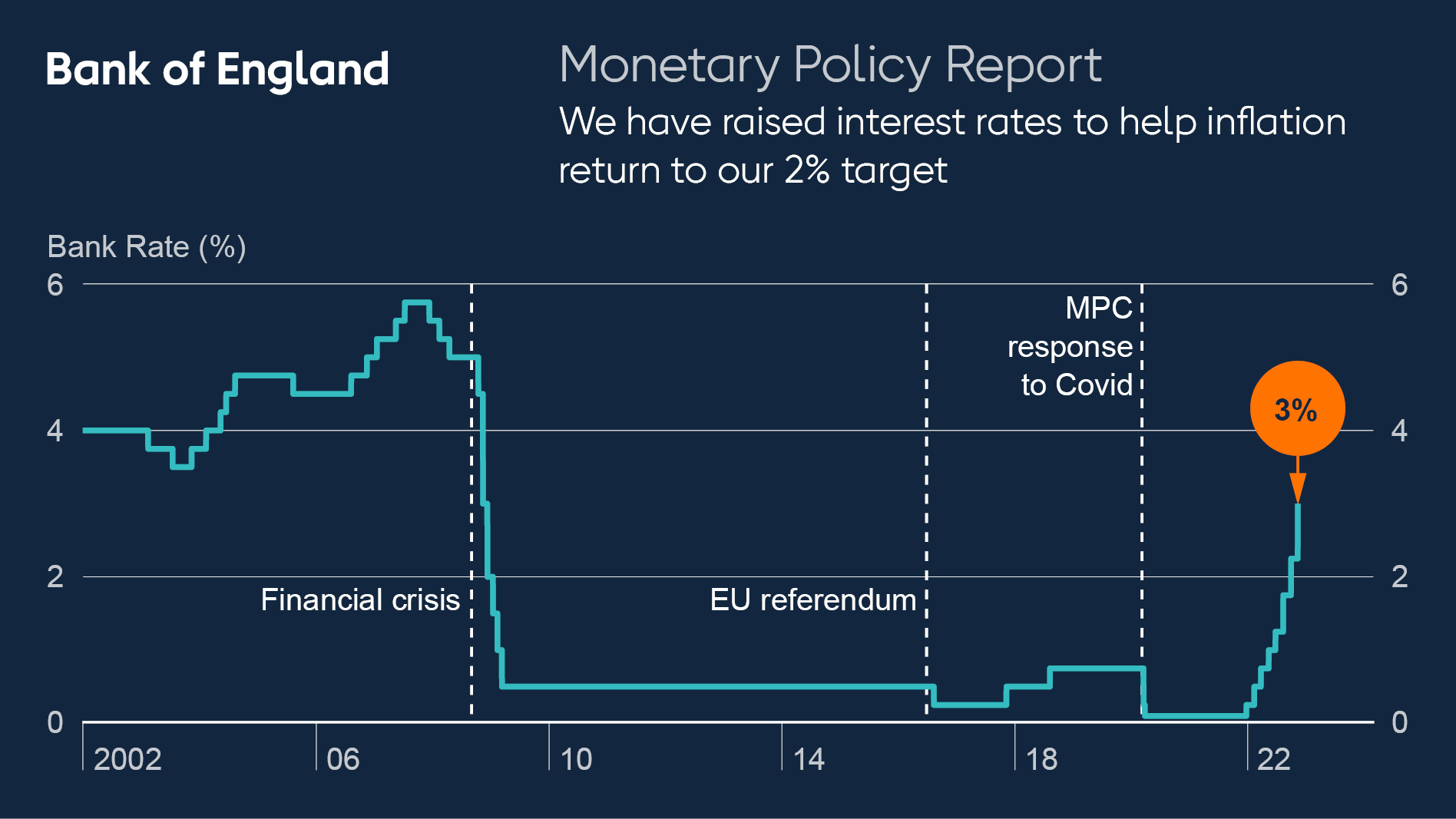

To use our calculator youll need to enter your remaining balance the number of years and months left on your mortgage and your current. The Bank of England has raised interest rates by 075 percentage points to 3 per cent in its most forceful act to tame inflation for 30 years but signalled that borrowing costs would not rise in. Bank Rate increased to 3 - November 2022.

Monetary Policy Summary and minutes of the Monetary Policy Committee meeting Read more about Bank Rate increased to 3 -. The base rate influences the interest rates that many lenders charge. The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate.

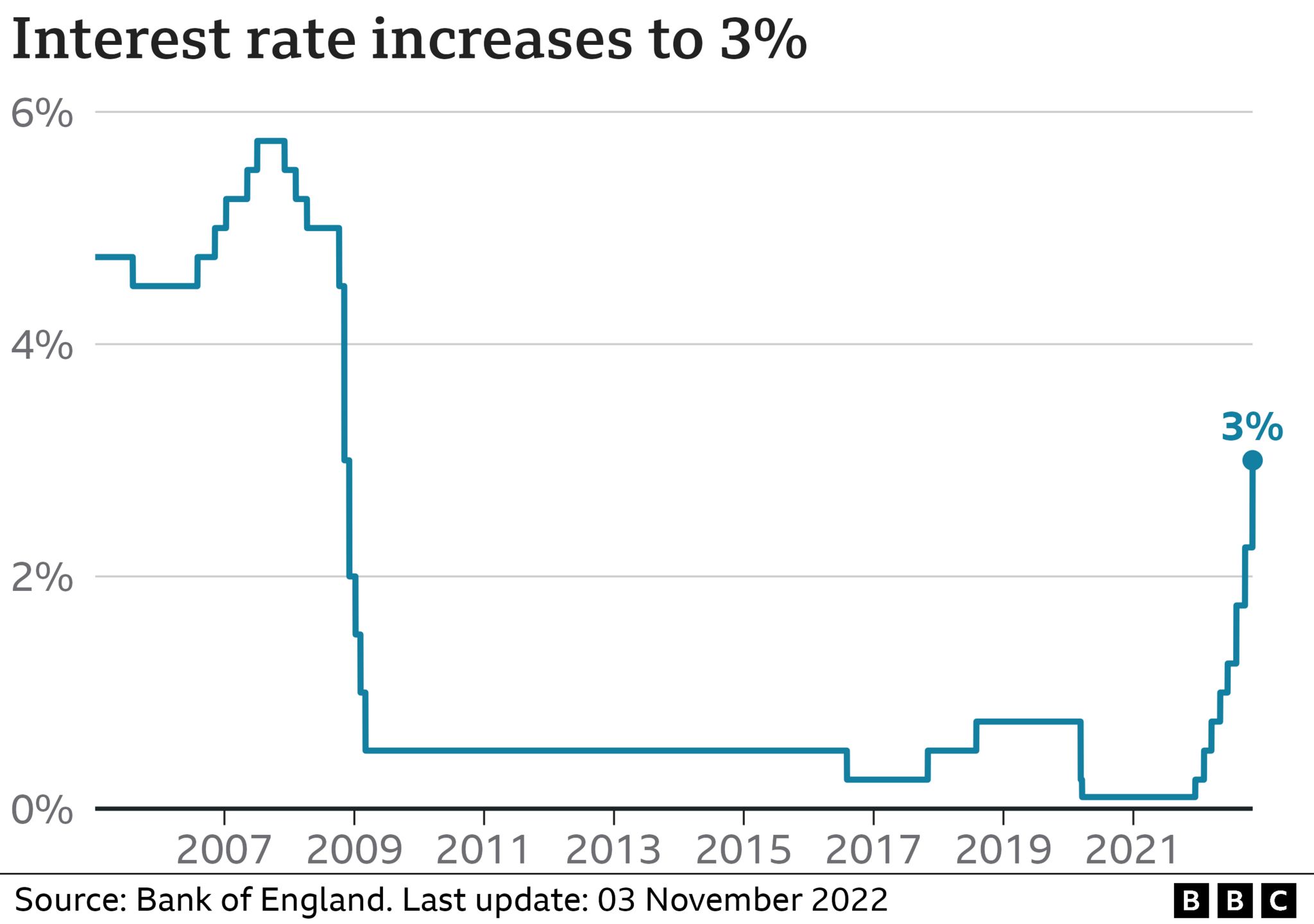

This rate is used by the central bank to charge other banks and lenders. 3 despite a plummet in sterling but will make big moves in November. On Thursday 3rd November 2022 the Bank of England announced an increase in its base rate from 225 to 3.

If you have a problem or question relating to the database please contact the DSD EditorReference Id 16308164031. The bank rate was raised in November 2021 to 025. The Bank of England has increased the base rate from 225 to 3 the largest single rise since 1989.

Five members voted to raise Bank Rate by 05 percentage. Its the rate the Bank of England charges other banks and other lenders when they borrow money and its currently 225. What has changed.

The base rate was increased from 225 to 3 on November 2022. This Bank of England interest rate decision was announced after the Monetary Policy Committee meeting on 3 November. It could rise to 075 in 2022 bringing it back to pre pandemic levels.

How to use our base rate change calculator. At its meeting ending on 21 September 2022 the MPC voted to increase Bank Rate by 05 percentage points to 225. The Bank of England wont raise interest rates before its next scheduled policy announcement on Nov.

The current Bank of England base rate is three per cent. Monetary Policy Report - November 2022. The Bank of England raised interest rates by three quarters of a percentage point on Thursday the biggest hike in 33 years as it tries to contain soaring.

While thats higher than it has been since the 2008 financial crisis its still considered on the low side historically keeping mortgage interest rates. The current base rate. The Bank of England has unveiled a 075 interest rate rise - the biggest since the 1980s - in a bid to control the runaway inflation.

London CNN Business. It is currently 05.

Bank Of England Set For Biggest Interest Rate Rise In 27 Years

Bank Of England Preview Edging Towards A 2022 Rate Hike Article Ing Think

Interest Rates Rise To 1 25 As Bank Of England Battles Rising Inflation The Independent

How The Bank Of England Set Interest Rates Economics Help

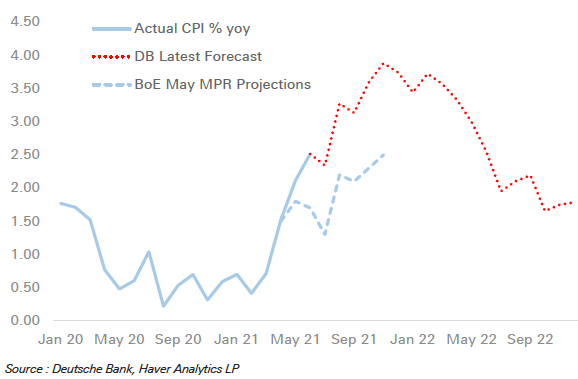

Bank Of England August 2022 Interest Rate Rise Now Likely Says Deutsche Bank

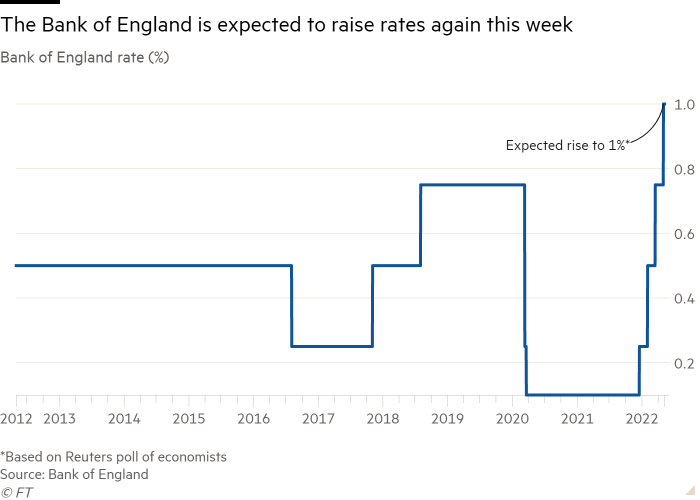

Market Expectations For Bank Of England Rate Rise Shift To Early 2022 Financial Times

Bank Of England Announces Biggest Interest Rate Hike In 27 Years

Bank Of England Poised To Raise Interest Rates Further To Curb Inflation Financial Times

Bank Of England Interest Rate Could Hit 4 Or More Ex Policymakers Warn

The Bank Of England Raises Its Interest Rate In Bid To Control Inflation The New York Times

Call On Bank Of England For 3 Interest Rate To Halt Runaway Inflation Business The Times

Bank Of England Interest Rate Predictions 1 25 By End Of 2022 Says Capital Economics